Fed rate hike

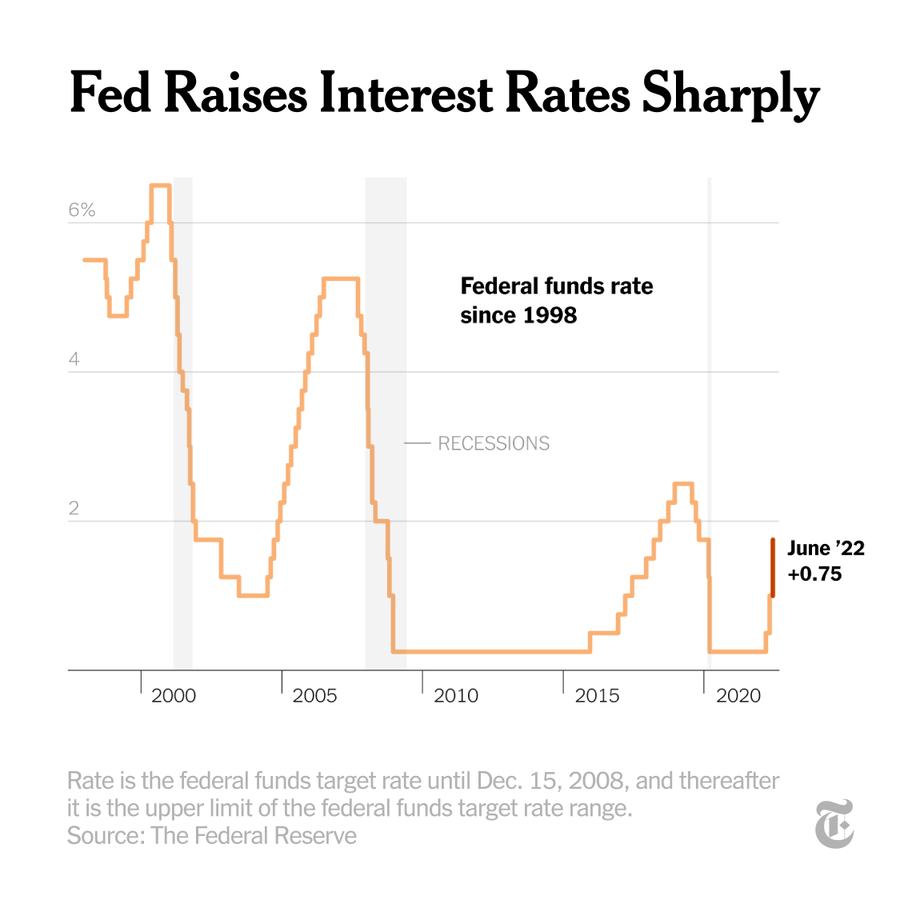

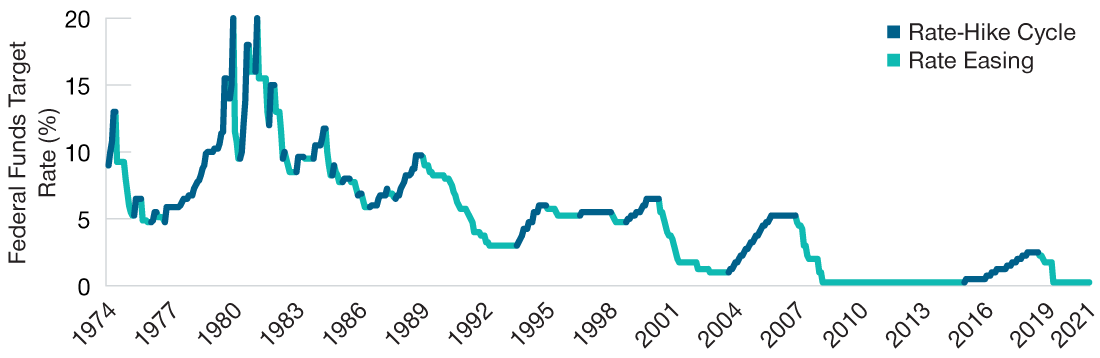

The Feds move raised its key short-term rate to a range of 375 percent to 4 percent its highest level in 15 years. The US Federal Reserve announced a 75 basis points bps rate hike in its FOMC meeting held on September 21.

Savers Have Yet To Benefit From This Fed Rate Hike Cycle Marketwatch

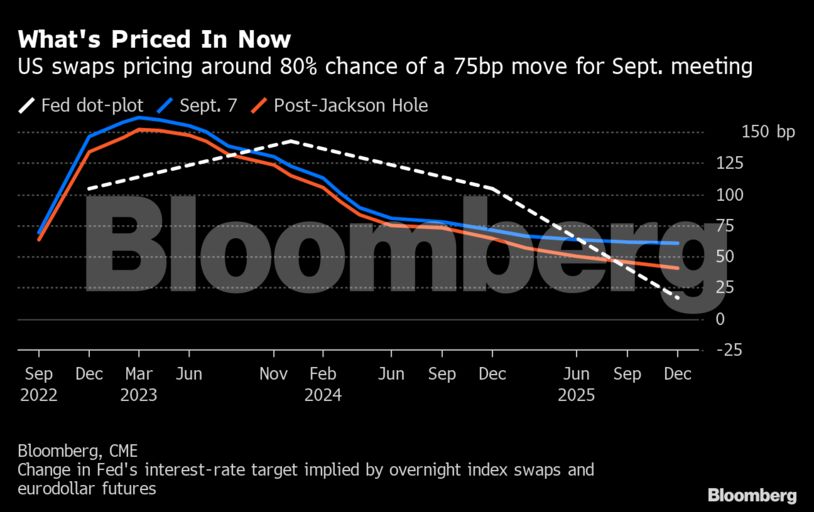

Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

. That implies a quarter-point rate rise next year but no. Nomura predicts the rate will be increased to a range of 325 to 35 at the Feds policy meeting this week and the Fed in Nomuras view will ultimately push that key rate as high as 475. Shares of cruise companies have fallen after the Feds latest rate hike Wednesday.

Market expectations are running high that policymakers will approve another rate hike but this time opting for a 05 percentage point or 50 basis point move. But what happens after the next Fed rate hike. The Federal Reserve is widely expected to deliver a fourth consecutive rate increase of 075 Wednesday afternoon.

A basis point equals 001 percentage point. Inflation data and a. By a unanimous vote the Fed.

Analysts and economists are confident the Fed will hike its baseline interest rate range by another 075 percentage points at the end of a Wednesday meeting. The rate hike brings the federal funds rate to a targeted range of 3 to 325 and the Fed said it anticipates that more rate hikes are on the horizon as it is strongly committed to returning. Market participants desperately.

Inflation Consumer inflation in Tokyo rises at fastest pace in 40 years. Bringing the Fed-funds rate target range to 375 to 400. Fed delivers 075-point rate hike signals possible smaller increases ahead.

The Federal Reserves last rate hike could come as soon as January but stocks will still be under pressure from dismal earnings into 2023 according to Morgan Stanley strategist Andrew Sheets. Central bank has. The Feds benchmark rate.

As of March 1 2016 the daily effective federal funds rate EFFR is a volume-weighted median of transaction-level data collected from depository institutions in the Report. The dot plot showed Fed officials expected rates to rise to 44 in 2022 and 46 next. Treasury yields were mostly higher with the two-year note the most sensitive to Fed rate hikes rising by nearly five basis points to 349.

Following the Feds September hike the stock market dropped 17 as the federal funds rate hit the 3 threshold. A strong majority of economists 44 of 72 predicted the central bank would hike its fed funds rate by 75 basis points next week after two such moves in June and July compared to only 20 who. The Federal Reserve Board of Governors in Washington DC.

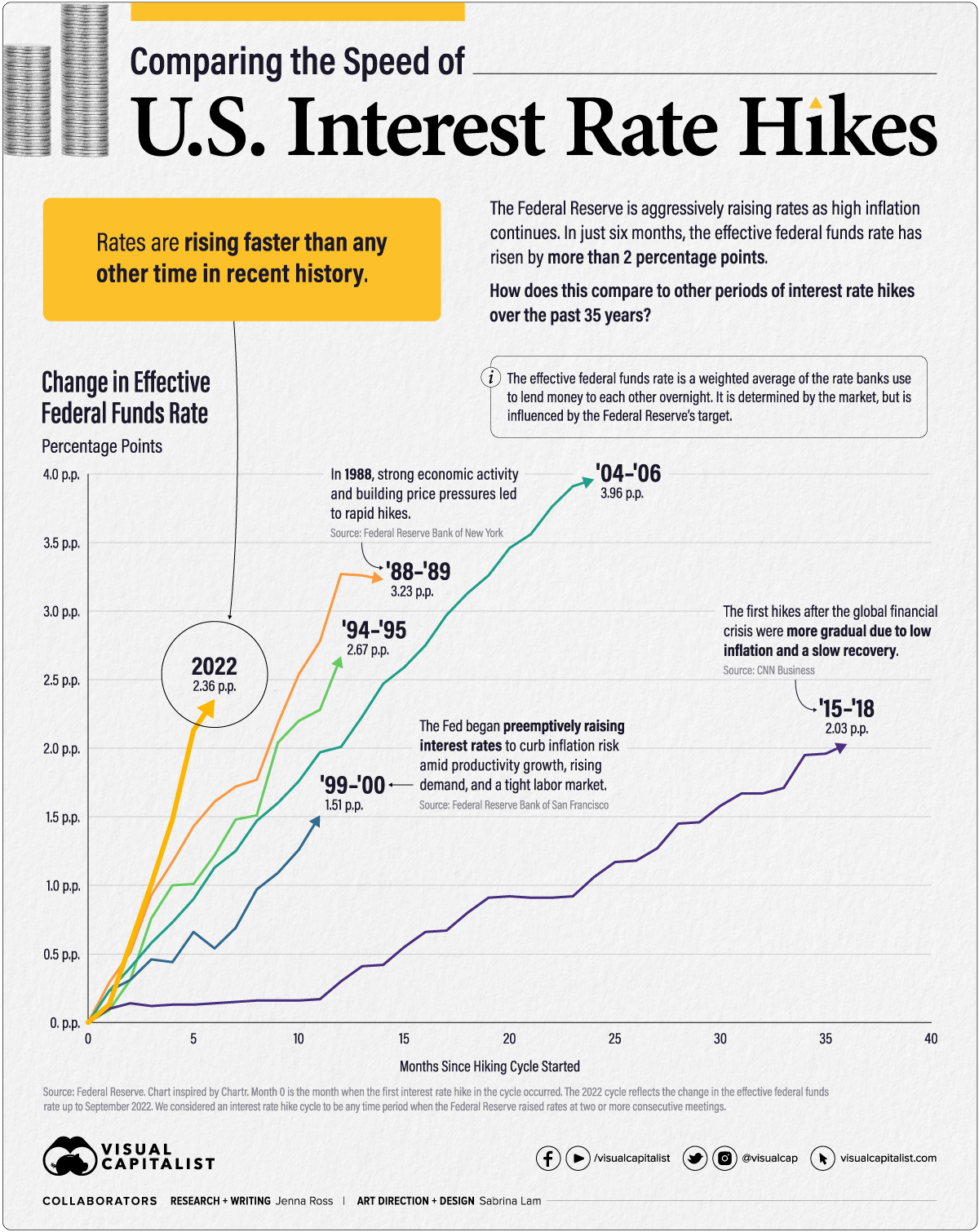

It is the central banks sixth rate hike of 2022 and fourth straight 075 percentage-point bump. Heading into the November meeting the Fed is eying a federal funds rate of 4. The Federal Reserve raised the target federal funds rate by 075 percentage point for the fourth time in a row on Wednesday marking an unprecedented pace of rate hikes.

After Feds rate hike announcement past increases hint at how stock market will react Jim Sergent USA TODAY Published 903 am UTC Oct. Board of Governors of the Federal Reserve System The Federal Reserve the central bank of the United States provides the nation with a safe flexible and stable monetary and financial system. That is as high as rates have been.

31 2022 Updated 1022 am UTC Nov. Gold miners are tallying strong gains in Thursdays trading as gold futures pushed past 1800oz for the first time since mid-August following milder than expected US. The Fed raised its benchmark rate by 075 percentage point in both June and July the largest back-to-back increases since the central bank started using the funds rate as its chief monetary.

Norwegian Carnival and Royal Caribbean have massive debt loads that grew during the pandemic. The Fed lifted its Fed Funds rate by 75 basis points matching the biggest move since 1994 to a range of 375 to 4 the highest since 2008 and said near-term rate moves would be needed in. The Feds move will mark the fourth.

It was the central banks sixth rate hike this year a streak that has made mortgages and other consumer and business loans increasingly expensive and heightened the risk of a recession. Recession fears rise as Fed eyes another interest rate hike. The Federal Reserve Board of Governors in Washington DC.

Federal Reserve Chairman Jerome Powell announced that the Fed will hike interest rates by 075 points on November 2 2022. The Federal Reserve on Wednesday approved the fourth straight jumbo interest-rate hike bringing its benchmark interest rate to the highest level in 15 years. Asian shares climb on Fed rate-hike slowdown China stimulus MSCIs broadest index of Asia-Pacific shares outside Japan rose 08 in early trade while the Nikkei surged 13 24 November 2022.

Fed Rate Hike Fed Traders Steer Toward A 75 Basis Point September Rate Hike The Economic Times

7 Uyhgp4vzykim

Comparing The Speed Of U S Interest Rate Hikes 1988 2022

Putting The Fed S Planned Rate Hikes Into Context T Rowe Price

On The Money Bracing For Another Fed Rate Hike The Hill

Just What Does A Fed Rate Hike Mean Samco Appraisal Management Company

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

A History Of Fed Leaders And Interest Rates The New York Times

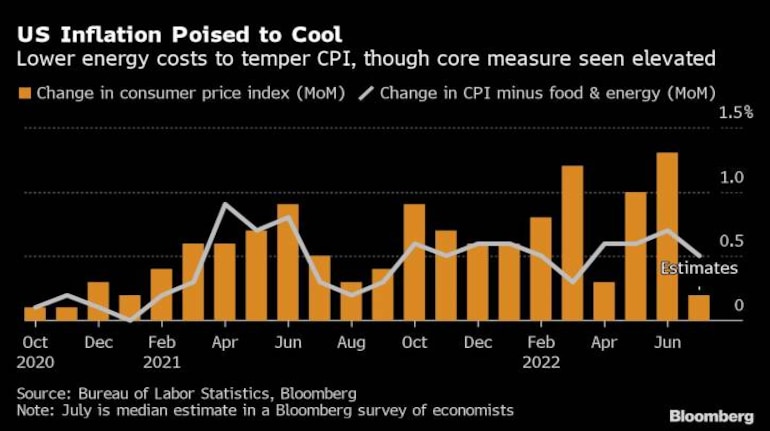

Respite In Us Inflation Unlikely To Derail Fed Rate Hike Plans

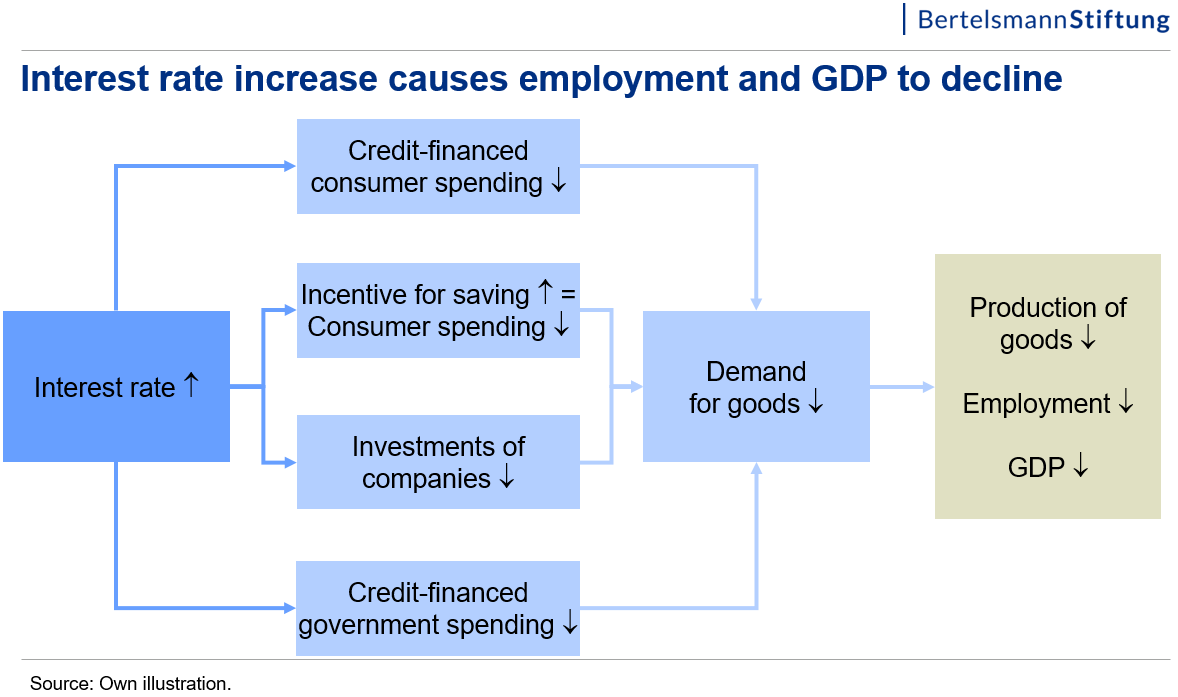

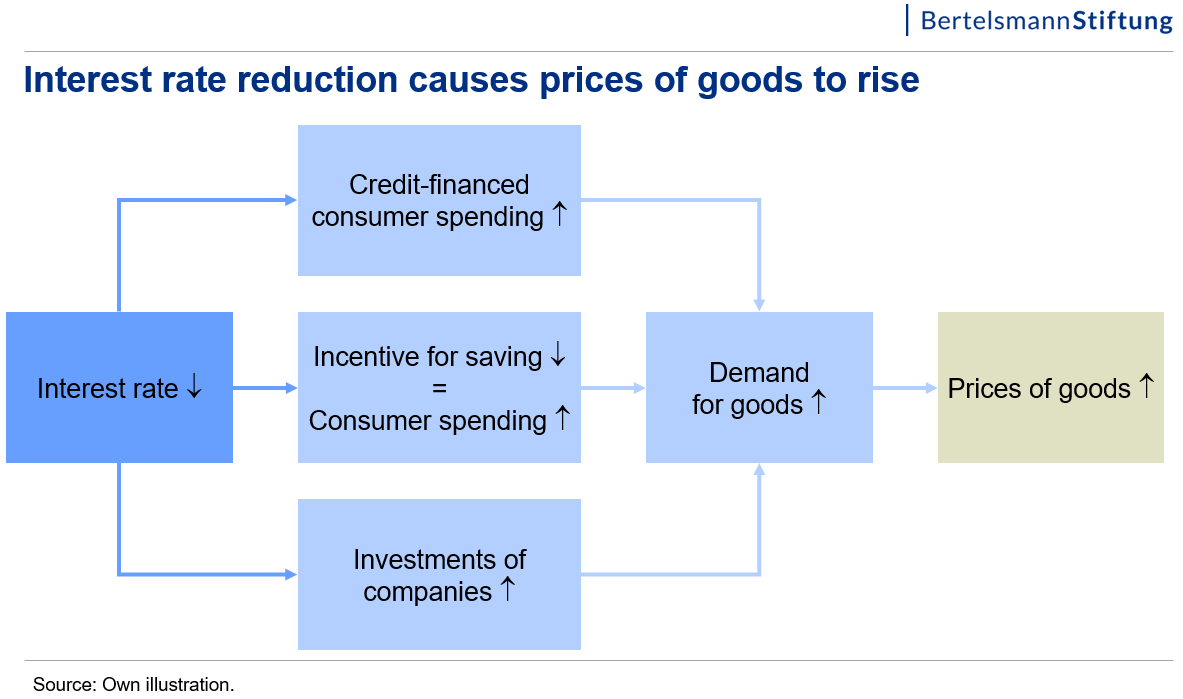

Interest Rate Hike By The Fed What Does It Mean For Europe

The Market Expects Another Three Quarter Point Interest Hike In November Then What Mish Talk Global Economic Trend Analysis

How The Fed S September Interest Rate Hike Will Affect You Money

:max_bytes(150000):strip_icc()/fredgraph-a800d4ef93634168b10b23290a1a57d1.png)

Federal Reserve Interest Rate Hikes In Investors Crosshairs

10 Year Yields Highest Since 2011 Before Expected Fed Rate Hike

S Ds On Expected Interest Rates Hike We Must Avoid Mistakes Of The Past And Protect The Most Vulnerable Europeans Socialists Democrats

Interest Rate Hike By The Fed What Does It Mean For Europe

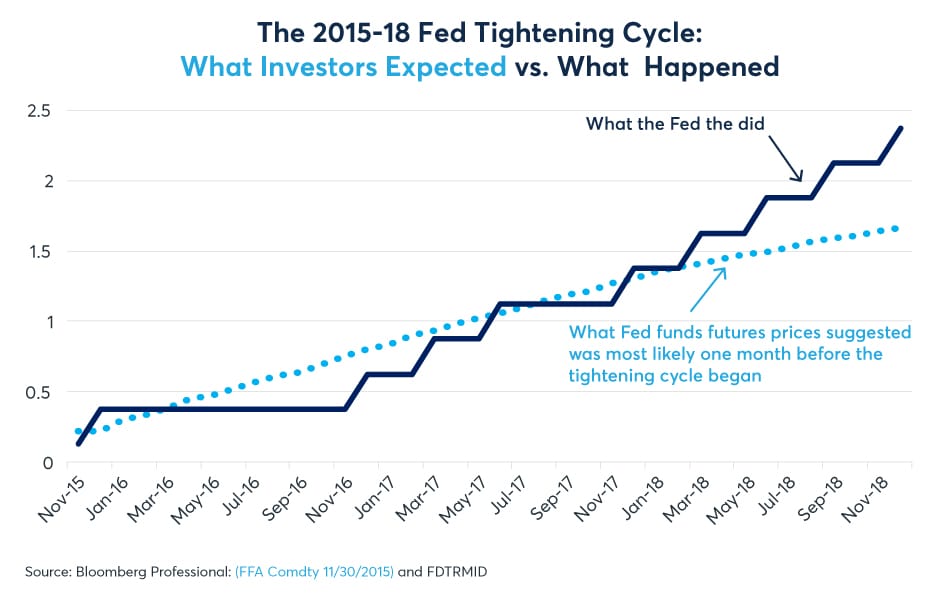

Fed Rate Hikes Expectations And Reality Cme Group